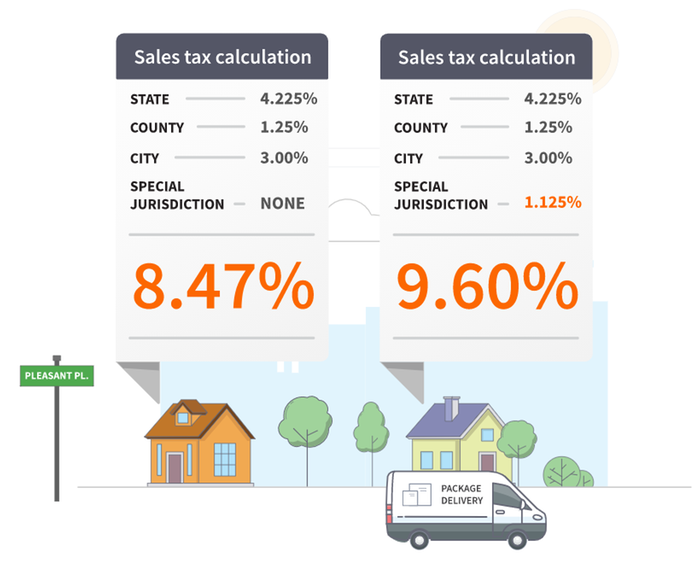

Automate Calculations

Sage Sales Tax, powered by Avalara provides cloud-based sales and use tax calculation with comprehensive, up-to-date tax rates pushed to your shopping cart or invoicing system, automatically.

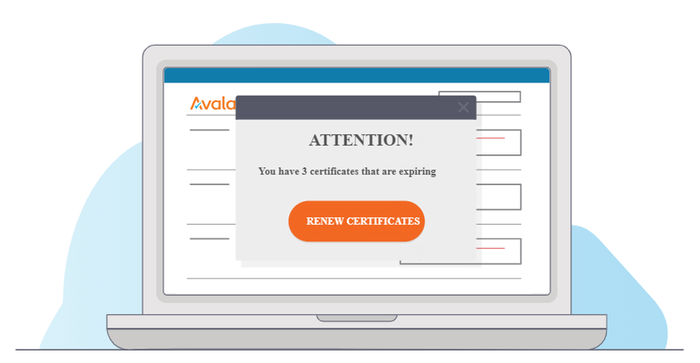

Automate Documentation

Avalara CertCapture is a scalable solution that securely collects, stores, and manages tax documents like exemption certificates, W-8s, and W-9s, in the cloud — for quick access to all your documentation whenever you need it.

Automate Filing

Avalara Returns uses your sales data to prepare and file your sales and use tax returns, and remit payments, across multiple jurisdictions every filing cycle.

Get Registered and Licensed

Avalara has licensing solutions for businesses large or small, simple or complex — and everywhere in between.

Determine Obligations

Understanding state nexus laws and knowing where you need to register can be complicated and risky if done on your own. Avalara's Sales Tax Risk Assessment helps make the process easier.